Succeeding in the complex world of the Forex market requires mastering practical strategies that are customized to its distinct intricacies. Among the most potent tactics in forex trading lies the fractal strategy.

This strategy empowers traders to pinpoint recurring price patterns, enabling them to forecast overarching price trends within the dynamic Forex market. In this blog post, we’ll thoroughly explore the Forex fractal strategy, illustrating its implementation with concrete real-world examples.

Understanding Fractals in the Forex Market

In the diverse landscape of financial markets, including Forex, the repetition of price patterns over various time spans is a common occurrence. This fundamental understanding underpins the concept of the fractal strategy.

Utilizing technical analysis, traders leverage the fractal strategy to spot these recurrent price patterns within the forex market. This, in turn, empowers them to foresee potential price shifts and make informed trading choices guided by these anticipations.

Comprising five candlesticks, the fractal pattern encapsulates market shifts, portraying the overarching trajectory of price fluctuations based on the recurrence of prior price patterns. This recurring pattern manifests multiple times across different timeframes on the fractal price chart.

Exploring Different Types of Fractal Patterns

There are two main categories of fractal patterns: ascending fractal patterns and descending fractal patterns.

In the descending fractal pattern, the price trend over a set time period is generally downward. The third candlestick, positioned at the center, represents the highest price value within that specific timeframe. The remaining candlesticks in this pattern hold lower values compared to the third one.

Conversely, the ascending fractal pattern signifies an overall upward price trend in a designated time interval, wherein the third candlestick holds a lower value than the surrounding candlesticks.

As an illustrative example, take a look at the chart provided below, which showcases a descending fractal pattern.

The shaded green area corresponds to our chosen time interval. Within this timeframe, the third candlestick, indicated in red, displays a value higher than both the two preceding and the two subsequent candlesticks.

Practical Implementation of the Fractal Strategy in Forex Trading

Leveraging data obtained from technical analysis and fractal charts offers crucial insights that guide well-informed decisions in the realm of Forex trading.

For example, when an ascending fractal pattern emerges on a price chart, with the third candlestick forming a price floor within the set time frame, it can act as a reliable signal for long or buying trades. Following the fifth candlestick, the appearance of the sixth candlestick could signify an opportunity for a higher-value buying entry.

Conversely, in the context of a descending fractal pattern, the third candlestick might indicate an appropriate entry point for short or selling trades. As the fifth candlestick concludes, the sixth candlestick could serve as a suitable exit point for selling, boasting a value lower than that of the third candlestick.

Furthermore, incorporating fractal indicator analysis can supply valuable signals for:

- Establishing exit points and determining stop-loss levels

- Grasping the overarching market trend – whether it leans bullish or bearish.

- Pinpointing potential entry and exit junctures.

- Identifying levels of price resistance in bullish markets.

- Identifying levels of price support in bearish markets.

Real-Life Application of the Fractal Strategy in Forex

Let’s take a practical look at how the fractal strategy can be employed in the forex market.

In the chart below, you can observe distinct fractal patterns. Ascending fractal patterns, represented by the green candlesticks, serve as signals for initiating buying or long positions. Conversely, the descending fractal patterns, indicated by the red candlesticks, act as cues for executing selling or short positions.

Assessing the Effectiveness of the Fractal Strategy in Forex Trading

Although the fractal strategy provides valuable insights to traders, it is not without its limitations. These drawbacks encompass:

- Like any form of analysis, fractal analysis cannot guarantee 100% accurate predictions of future prices and may occasionally misguide traders.

- Solely relying on this strategy to determine the optimal entry point might prove challenging, as the indicated price floor could be lower than the actual entry point. This challenge is not exclusive to fractal indicators and is present in other strategies as well. Combining multiple strategies can improve the accuracy of entry point identification.

- Implementing stop-loss points based solely on fractal analysis could potentially lead to significant losses.

Depending solely on the fractal strategy for forex trading, without considering other analytical methods and strategies, carries a high risk and increases the likelihood of incurring losses.

Experienced traders often integrate fractal analysis with other strategies, such as the alligator strategy, to mitigate risks and enhance the quality of their trading decisions.

Simultaneous Application of Fractal and Alligator Strategies

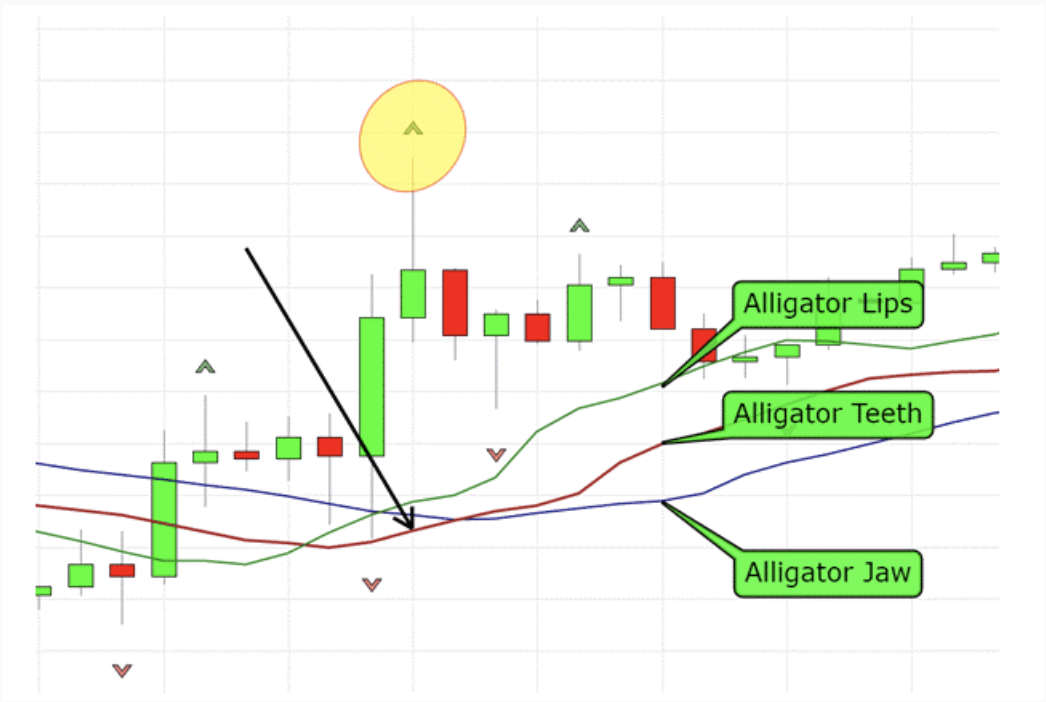

Among the array of widely-used Williams’ indicators, two strategies notably stand out: fractal analysis and alligator analysis. These indicators can be seamlessly integrated into platforms such as MetaTrader or other forex trading platforms, providing traders with visual representations of their insights on the chart.

The alligator indicator employs three lines: the red line symbolizes the alligator’s teeth, the blue line represents the alligator’s jaw, and the green line signifies the alligator’s lips.

When these lines converge, implying a dormant alligator, the market showcases distinct upward or downward movements. Conversely, when these lines diverge, the market may undergo an upward or downward trend.

Buy Signal

An ascending fractal pattern surpassing the red line of the alligator indicator, indicating an upward price trend, signifies a buy signal. Even if you don’t intend to buy, it’s advisable to abstain from selling under these conditions.

Sell Signal

A descending fractal pattern below the red line of the alligator indicator, reflecting a downward price trend, signifies a sell signal.

Blending the fractal and alligator strategies can complement each other, resulting in signals that boast relatively low error rates.

Securing Adequate Capital for Forex Trading

Experienced traders and professionals looking to invest in the Forex market can leverage the prop trading platform, Propiy. By employing strategies like the fractal strategy, traders can attain substantial profits within this enticing market.

Propiy serves as a prop trading platform that expeditiously facilitates traders in becoming account holders, enabling them to initiate Forex trading with minimal initial capital. Through engagement in Propiy’s free challenge, you can acquaint yourself with trading dynamics and hone your skills in utilizing the analytical panel. This equips you to test diverse Forex broker servers.

At Propiy, we’ve established an optimal platform for adept traders to harvest considerable profits from the Forex market without necessitating a substantial capital outlay. For further information, please visit the Propiy website.

Note: These elements alone may not suffice for executing trades and should not constitute the sole foundation for trading decisions. Always exercise caution and refrain from exclusively relying on these concepts for trading purposes.

The use of offensive and immoral words and content in any form and by any person is prohibited.

Publishing any non-economic views, promoting the site, promoting social network pages, including contact information and unrelated links is not allowed.

Comments that violate the above rules will not be approved.